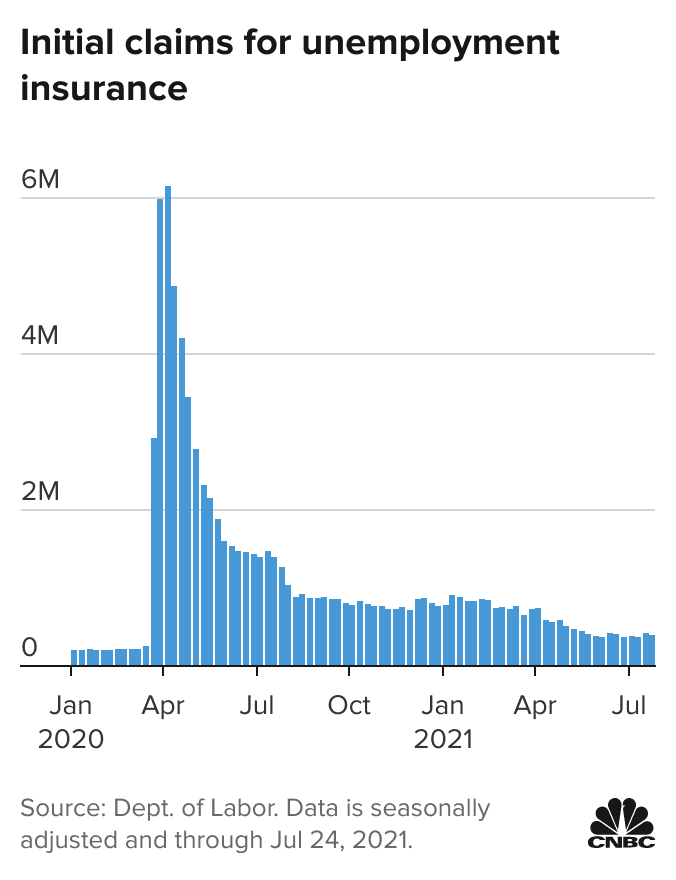

Collection of Ct unemployment claim on hold 2021 ~ Im trying to find out if this is due to processing issues with CT DOL or if they are waiting responses and information from employer. Unemployment claims edged up to 353000 last week from a revised 349000 a week earlier the Labor Department said Thursday.

as we know it lately is being hunted by users around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of this post I will discuss about Ct Unemployment Claim On Hold 2021 In all the state reported to the federal government that it identified more than 86 million tied to overpayments between April and June of this year.

Ct unemployment claim on hold 2021

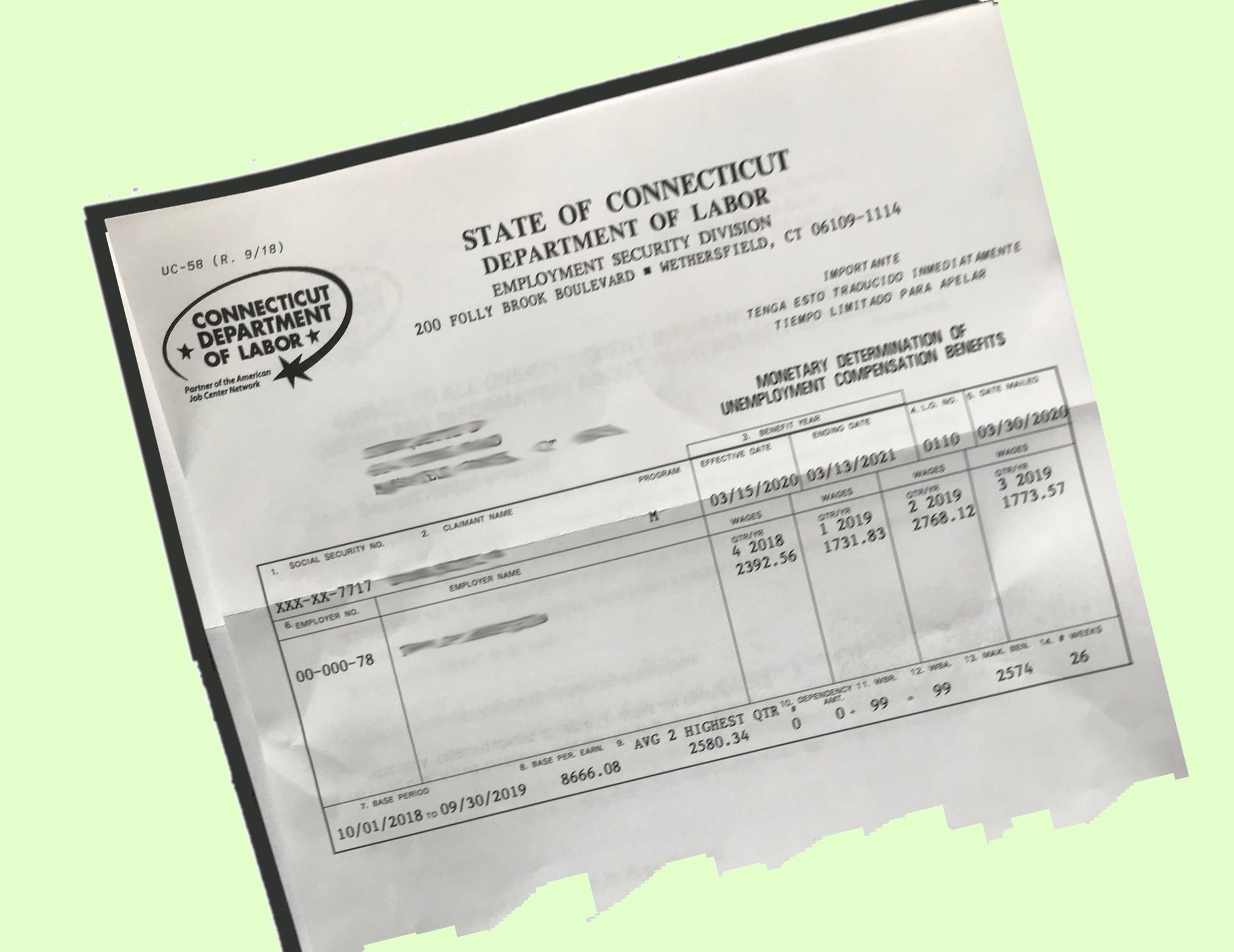

Collection of Ct unemployment claim on hold 2021 ~ Get tax info 1099G form File your application for Extended Benefits EB Received an extended benefits letter. Get tax info 1099G form File your application for Extended Benefits EB Received an extended benefits letter. Get tax info 1099G form File your application for Extended Benefits EB Received an extended benefits letter. Get tax info 1099G form File your application for Extended Benefits EB Received an extended benefits letter. 35 billion in unemployment benefits as follows. 35 billion in unemployment benefits as follows. 35 billion in unemployment benefits as follows. 35 billion in unemployment benefits as follows. 23 billion in state unemployment benefits. 23 billion in state unemployment benefits. 23 billion in state unemployment benefits. 23 billion in state unemployment benefits.

Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. This number is NOT accessible statewide. This number is NOT accessible statewide. This number is NOT accessible statewide. This number is NOT accessible statewide. Connecticuts unemployment-taxable wage base is to remain at 15000 in 2021 unchanged. Connecticuts unemployment-taxable wage base is to remain at 15000 in 2021 unchanged. Connecticuts unemployment-taxable wage base is to remain at 15000 in 2021 unchanged. Connecticuts unemployment-taxable wage base is to remain at 15000 in 2021 unchanged.

Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. 8 weeks of message 42 i call 3 times a week last call i was told by CT employee she removed the hold and straight up lied to me that she was gonna call me back blah blah blah called today and Jose guy said he or his supervisor cant help me with it at all Wtf is going on i paid taxes and worked for 40 years not my fault Covid shut down the body shop i worked at now Im homeless all i have left. 8 weeks of message 42 i call 3 times a week last call i was told by CT employee she removed the hold and straight up lied to me that she was gonna call me back blah blah blah called today and Jose guy said he or his supervisor cant help me with it at all Wtf is going on i paid taxes and worked for 40 years not my fault Covid shut down the body shop i worked at now Im homeless all i have left. 8 weeks of message 42 i call 3 times a week last call i was told by CT employee she removed the hold and straight up lied to me that she was gonna call me back blah blah blah called today and Jose guy said he or his supervisor cant help me with it at all Wtf is going on i paid taxes and worked for 40 years not my fault Covid shut down the body shop i worked at now Im homeless all i have left. 8 weeks of message 42 i call 3 times a week last call i was told by CT employee she removed the hold and straight up lied to me that she was gonna call me back blah blah blah called today and Jose guy said he or his supervisor cant help me with it at all Wtf is going on i paid taxes and worked for 40 years not my fault Covid shut down the body shop i worked at now Im homeless all i have left. Supplements are automatically attached to regular benefits. Supplements are automatically attached to regular benefits. Supplements are automatically attached to regular benefits. Supplements are automatically attached to regular benefits.

Claims are filed online. Claims are filed online. Claims are filed online. Claims are filed online. Effective January 1 2021 unemployment tax rates for experienced employers are to range from 190 to 680. Effective January 1 2021 unemployment tax rates for experienced employers are to range from 190 to 680. Effective January 1 2021 unemployment tax rates for experienced employers are to range from 190 to 680. Effective January 1 2021 unemployment tax rates for experienced employers are to range from 190 to 680. Although the unemployment rate is improving. Although the unemployment rate is improving. Although the unemployment rate is improving. Although the unemployment rate is improving.

FPUC provides an additional 300 per week benefit for all claimants regardless of which unemployment program they use. FPUC provides an additional 300 per week benefit for all claimants regardless of which unemployment program they use. FPUC provides an additional 300 per week benefit for all claimants regardless of which unemployment program they use. FPUC provides an additional 300 per week benefit for all claimants regardless of which unemployment program they use. Claims have been above 800000 for three consecutive weeks. Claims have been above 800000 for three consecutive weeks. Claims have been above 800000 for three consecutive weeks. Claims have been above 800000 for three consecutive weeks. Login issues with initial claims filing system bluebutton. Login issues with initial claims filing system bluebutton. Login issues with initial claims filing system bluebutton. Login issues with initial claims filing system bluebutton.

The four-week moving average which smooths out. The four-week moving average which smooths out. The four-week moving average which smooths out. The four-week moving average which smooths out. But Candelora is also worried about the long-term health of states unemployment trust fund and the Connecticut businesses that pay taxes into that system. But Candelora is also worried about the long-term health of states unemployment trust fund and the Connecticut businesses that pay taxes into that system. But Candelora is also worried about the long-term health of states unemployment trust fund and the Connecticut businesses that pay taxes into that system. But Candelora is also worried about the long-term health of states unemployment trust fund and the Connecticut businesses that pay taxes into that system. In fact the situation grew so bad in the past year that the state was forced to take out a 725 million loan. In fact the situation grew so bad in the past year that the state was forced to take out a 725 million loan. In fact the situation grew so bad in the past year that the state was forced to take out a 725 million loan. In fact the situation grew so bad in the past year that the state was forced to take out a 725 million loan.

1-800-842-9710 This is a relay service that can connect you to the numbers listed above in order to file your claim by telephone. 1-800-842-9710 This is a relay service that can connect you to the numbers listed above in order to file your claim by telephone. 1-800-842-9710 This is a relay service that can connect you to the numbers listed above in order to file your claim by telephone. 1-800-842-9710 This is a relay service that can connect you to the numbers listed above in order to file your claim by telephone. A pair of Connecticut lawmakers are calling on the state Department of Labor to forgive millions of dollars in overpayments that were made through the unemployment system. A pair of Connecticut lawmakers are calling on the state Department of Labor to forgive millions of dollars in overpayments that were made through the unemployment system. A pair of Connecticut lawmakers are calling on the state Department of Labor to forgive millions of dollars in overpayments that were made through the unemployment system. A pair of Connecticut lawmakers are calling on the state Department of Labor to forgive millions of dollars in overpayments that were made through the unemployment system. 485 million in Pandemic Unemployment Assistance PUA. 485 million in Pandemic Unemployment Assistance PUA. 485 million in Pandemic Unemployment Assistance PUA. 485 million in Pandemic Unemployment Assistance PUA.

April 28 2021 at 1154 am. April 28 2021 at 1154 am. April 28 2021 at 1154 am. April 28 2021 at 1154 am. The rates are to include a fund-solvency surtax of 140. The rates are to include a fund-solvency surtax of 140. The rates are to include a fund-solvency surtax of 140. The rates are to include a fund-solvency surtax of 140. Wethersfield CT Connecticut Department of Labor CTDOL Commissioner Kurt Westby today reported that the February 2021 unemployment rate rose to 85 from 81 in January. Wethersfield CT Connecticut Department of Labor CTDOL Commissioner Kurt Westby today reported that the February 2021 unemployment rate rose to 85 from 81 in January. Wethersfield CT Connecticut Department of Labor CTDOL Commissioner Kurt Westby today reported that the February 2021 unemployment rate rose to 85 from 81 in January. Wethersfield CT Connecticut Department of Labor CTDOL Commissioner Kurt Westby today reported that the February 2021 unemployment rate rose to 85 from 81 in January.

The FPUC program is in effect in Connecticut until the week ending September 4 2021. The FPUC program is in effect in Connecticut until the week ending September 4 2021. The FPUC program is in effect in Connecticut until the week ending September 4 2021. The FPUC program is in effect in Connecticut until the week ending September 4 2021. Filed 5 so far all Held with Code 30. Filed 5 so far all Held with Code 30. Filed 5 so far all Held with Code 30. Filed 5 so far all Held with Code 30. Claim on hold and called last week the person said my holds will be off hold an my unemployment claims have been put on hold for the past weeks and I can not I have been trying to reach a live person in Connecticut unemployment have questi. Claim on hold and called last week the person said my holds will be off hold an my unemployment claims have been put on hold for the past weeks and I can not I have been trying to reach a live person in Connecticut unemployment have questi. Claim on hold and called last week the person said my holds will be off hold an my unemployment claims have been put on hold for the past weeks and I can not I have been trying to reach a live person in Connecticut unemployment have questi. Claim on hold and called last week the person said my holds will be off hold an my unemployment claims have been put on hold for the past weeks and I can not I have been trying to reach a live person in Connecticut unemployment have questi.

Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. TeleBenefits Phone Number Out of State Calling Area. TeleBenefits Phone Number Out of State Calling Area. TeleBenefits Phone Number Out of State Calling Area. TeleBenefits Phone Number Out of State Calling Area.

The three-month average unemployment rate in Connecticut is 83 which under the federal High Extended Benefits program triggers an additional seven weeks of unemployment benefits for claimants. The three-month average unemployment rate in Connecticut is 83 which under the federal High Extended Benefits program triggers an additional seven weeks of unemployment benefits for claimants. The three-month average unemployment rate in Connecticut is 83 which under the federal High Extended Benefits program triggers an additional seven weeks of unemployment benefits for claimants. The three-month average unemployment rate in Connecticut is 83 which under the federal High Extended Benefits program triggers an additional seven weeks of unemployment benefits for claimants. Claim Inquiry on your website says that my claim is on hold. Claim Inquiry on your website says that my claim is on hold. Claim Inquiry on your website says that my claim is on hold. Claim Inquiry on your website says that my claim is on hold. Filed on 317 claim accepted on 321 with instructions to file weekly claims. Filed on 317 claim accepted on 321 with instructions to file weekly claims. Filed on 317 claim accepted on 321 with instructions to file weekly claims. Filed on 317 claim accepted on 321 with instructions to file weekly claims.

Week ending claim held pending determination My weekly benefit rate is listed as 0 so Im wondering if this is being held pending calculation of my benefit rate. Week ending claim held pending determination My weekly benefit rate is listed as 0 so Im wondering if this is being held pending calculation of my benefit rate. Week ending claim held pending determination My weekly benefit rate is listed as 0 so Im wondering if this is being held pending calculation of my benefit rate. Week ending claim held pending determination My weekly benefit rate is listed as 0 so Im wondering if this is being held pending calculation of my benefit rate. Select a benefits payment option. Select a benefits payment option. Select a benefits payment option. Select a benefits payment option. Claimants do not need to apply for the program. Claimants do not need to apply for the program. Claimants do not need to apply for the program. Claimants do not need to apply for the program.

Mixed Earner Unemployment Compensation MEUC File for Pandemic Unemployment Assistance PUA File your weekly PUA certification. Mixed Earner Unemployment Compensation MEUC File for Pandemic Unemployment Assistance PUA File your weekly PUA certification. Mixed Earner Unemployment Compensation MEUC File for Pandemic Unemployment Assistance PUA File your weekly PUA certification. Mixed Earner Unemployment Compensation MEUC File for Pandemic Unemployment Assistance PUA File your weekly PUA certification. Thats a huge uptick from the previous six years when the state reported on average around 3 million in overpayments each quarter. Thats a huge uptick from the previous six years when the state reported on average around 3 million in overpayments each quarter. Thats a huge uptick from the previous six years when the state reported on average around 3 million in overpayments each quarter. Thats a huge uptick from the previous six years when the state reported on average around 3 million in overpayments each quarter. Check status of your weekly claim or manage your account. Check status of your weekly claim or manage your account. Check status of your weekly claim or manage your account. Check status of your weekly claim or manage your account.

The tax rate for new-employers is set to be 300 for 2021 a decrease from 320 in 2020. The tax rate for new-employers is set to be 300 for 2021 a decrease from 320 in 2020. The tax rate for new-employers is set to be 300 for 2021 a decrease from 320 in 2020. The tax rate for new-employers is set to be 300 for 2021 a decrease from 320 in 2020. That fund took a huge hit over the past year as the state paid out billions of dollars to more than half a million unemployment applicants. That fund took a huge hit over the past year as the state paid out billions of dollars to more than half a million unemployment applicants. That fund took a huge hit over the past year as the state paid out billions of dollars to more than half a million unemployment applicants. That fund took a huge hit over the past year as the state paid out billions of dollars to more than half a million unemployment applicants. Jobless claims fell by 14000 to 340000 last week a new pandemic low as businesses hold on to workers despite the surging Delta variant. Jobless claims fell by 14000 to 340000 last week a new pandemic low as businesses hold on to workers despite the surging Delta variant. Jobless claims fell by 14000 to 340000 last week a new pandemic low as businesses hold on to workers despite the surging Delta variant. Jobless claims fell by 14000 to 340000 last week a new pandemic low as businesses hold on to workers despite the surging Delta variant.

2

Source Image @

Ct unemployment claim on hold 2021 | 2

Collection of Ct unemployment claim on hold 2021 ~ Get tax info 1099G form File your application for Extended Benefits EB Received an extended benefits letter. Get tax info 1099G form File your application for Extended Benefits EB Received an extended benefits letter. Get tax info 1099G form File your application for Extended Benefits EB Received an extended benefits letter. 35 billion in unemployment benefits as follows. 35 billion in unemployment benefits as follows. 35 billion in unemployment benefits as follows. 23 billion in state unemployment benefits. 23 billion in state unemployment benefits. 23 billion in state unemployment benefits.

Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. This number is NOT accessible statewide. This number is NOT accessible statewide. This number is NOT accessible statewide. Connecticuts unemployment-taxable wage base is to remain at 15000 in 2021 unchanged. Connecticuts unemployment-taxable wage base is to remain at 15000 in 2021 unchanged. Connecticuts unemployment-taxable wage base is to remain at 15000 in 2021 unchanged.

Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. 8 weeks of message 42 i call 3 times a week last call i was told by CT employee she removed the hold and straight up lied to me that she was gonna call me back blah blah blah called today and Jose guy said he or his supervisor cant help me with it at all Wtf is going on i paid taxes and worked for 40 years not my fault Covid shut down the body shop i worked at now Im homeless all i have left. 8 weeks of message 42 i call 3 times a week last call i was told by CT employee she removed the hold and straight up lied to me that she was gonna call me back blah blah blah called today and Jose guy said he or his supervisor cant help me with it at all Wtf is going on i paid taxes and worked for 40 years not my fault Covid shut down the body shop i worked at now Im homeless all i have left. 8 weeks of message 42 i call 3 times a week last call i was told by CT employee she removed the hold and straight up lied to me that she was gonna call me back blah blah blah called today and Jose guy said he or his supervisor cant help me with it at all Wtf is going on i paid taxes and worked for 40 years not my fault Covid shut down the body shop i worked at now Im homeless all i have left. Supplements are automatically attached to regular benefits. Supplements are automatically attached to regular benefits. Supplements are automatically attached to regular benefits.

Claims are filed online. Claims are filed online. Claims are filed online. Effective January 1 2021 unemployment tax rates for experienced employers are to range from 190 to 680. Effective January 1 2021 unemployment tax rates for experienced employers are to range from 190 to 680. Effective January 1 2021 unemployment tax rates for experienced employers are to range from 190 to 680. Although the unemployment rate is improving. Although the unemployment rate is improving. Although the unemployment rate is improving.

FPUC provides an additional 300 per week benefit for all claimants regardless of which unemployment program they use. FPUC provides an additional 300 per week benefit for all claimants regardless of which unemployment program they use. FPUC provides an additional 300 per week benefit for all claimants regardless of which unemployment program they use. Claims have been above 800000 for three consecutive weeks. Claims have been above 800000 for three consecutive weeks. Claims have been above 800000 for three consecutive weeks. Login issues with initial claims filing system bluebutton. Login issues with initial claims filing system bluebutton. Login issues with initial claims filing system bluebutton.

The four-week moving average which smooths out. The four-week moving average which smooths out. The four-week moving average which smooths out. But Candelora is also worried about the long-term health of states unemployment trust fund and the Connecticut businesses that pay taxes into that system. But Candelora is also worried about the long-term health of states unemployment trust fund and the Connecticut businesses that pay taxes into that system. But Candelora is also worried about the long-term health of states unemployment trust fund and the Connecticut businesses that pay taxes into that system. In fact the situation grew so bad in the past year that the state was forced to take out a 725 million loan. In fact the situation grew so bad in the past year that the state was forced to take out a 725 million loan. In fact the situation grew so bad in the past year that the state was forced to take out a 725 million loan.

1-800-842-9710 This is a relay service that can connect you to the numbers listed above in order to file your claim by telephone. 1-800-842-9710 This is a relay service that can connect you to the numbers listed above in order to file your claim by telephone. 1-800-842-9710 This is a relay service that can connect you to the numbers listed above in order to file your claim by telephone. A pair of Connecticut lawmakers are calling on the state Department of Labor to forgive millions of dollars in overpayments that were made through the unemployment system. A pair of Connecticut lawmakers are calling on the state Department of Labor to forgive millions of dollars in overpayments that were made through the unemployment system. A pair of Connecticut lawmakers are calling on the state Department of Labor to forgive millions of dollars in overpayments that were made through the unemployment system. 485 million in Pandemic Unemployment Assistance PUA. 485 million in Pandemic Unemployment Assistance PUA. 485 million in Pandemic Unemployment Assistance PUA.

April 28 2021 at 1154 am. April 28 2021 at 1154 am. April 28 2021 at 1154 am. The rates are to include a fund-solvency surtax of 140. The rates are to include a fund-solvency surtax of 140. The rates are to include a fund-solvency surtax of 140. Wethersfield CT Connecticut Department of Labor CTDOL Commissioner Kurt Westby today reported that the February 2021 unemployment rate rose to 85 from 81 in January. Wethersfield CT Connecticut Department of Labor CTDOL Commissioner Kurt Westby today reported that the February 2021 unemployment rate rose to 85 from 81 in January. Wethersfield CT Connecticut Department of Labor CTDOL Commissioner Kurt Westby today reported that the February 2021 unemployment rate rose to 85 from 81 in January.

The FPUC program is in effect in Connecticut until the week ending September 4 2021. The FPUC program is in effect in Connecticut until the week ending September 4 2021. The FPUC program is in effect in Connecticut until the week ending September 4 2021. Filed 5 so far all Held with Code 30. Filed 5 so far all Held with Code 30. Filed 5 so far all Held with Code 30. Claim on hold and called last week the person said my holds will be off hold an my unemployment claims have been put on hold for the past weeks and I can not I have been trying to reach a live person in Connecticut unemployment have questi. Claim on hold and called last week the person said my holds will be off hold an my unemployment claims have been put on hold for the past weeks and I can not I have been trying to reach a live person in Connecticut unemployment have questi. Claim on hold and called last week the person said my holds will be off hold an my unemployment claims have been put on hold for the past weeks and I can not I have been trying to reach a live person in Connecticut unemployment have questi.

Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. Ct Unemployment Claim On Hold. TeleBenefits Phone Number Out of State Calling Area. TeleBenefits Phone Number Out of State Calling Area. TeleBenefits Phone Number Out of State Calling Area.

The three-month average unemployment rate in Connecticut is 83 which under the federal High Extended Benefits program triggers an additional seven weeks of unemployment benefits for claimants. The three-month average unemployment rate in Connecticut is 83 which under the federal High Extended Benefits program triggers an additional seven weeks of unemployment benefits for claimants. The three-month average unemployment rate in Connecticut is 83 which under the federal High Extended Benefits program triggers an additional seven weeks of unemployment benefits for claimants. Claim Inquiry on your website says that my claim is on hold. Claim Inquiry on your website says that my claim is on hold. Claim Inquiry on your website says that my claim is on hold. Filed on 317 claim accepted on 321 with instructions to file weekly claims. Filed on 317 claim accepted on 321 with instructions to file weekly claims. Filed on 317 claim accepted on 321 with instructions to file weekly claims.

Week ending claim held pending determination My weekly benefit rate is listed as 0 so Im wondering if this is being held pending calculation of my benefit rate. Week ending claim held pending determination My weekly benefit rate is listed as 0 so Im wondering if this is being held pending calculation of my benefit rate. Week ending claim held pending determination My weekly benefit rate is listed as 0 so Im wondering if this is being held pending calculation of my benefit rate. Select a benefits payment option. Select a benefits payment option. Select a benefits payment option. Claimants do not need to apply for the program. Claimants do not need to apply for the program. Claimants do not need to apply for the program.

Mixed Earner Unemployment Compensation MEUC File for Pandemic Unemployment Assistance PUA File your weekly PUA certification. Mixed Earner Unemployment Compensation MEUC File for Pandemic Unemployment Assistance PUA File your weekly PUA certification. Mixed Earner Unemployment Compensation MEUC File for Pandemic Unemployment Assistance PUA File your weekly PUA certification. Thats a huge uptick from the previous six years when the state reported on average around 3 million in overpayments each quarter. Thats a huge uptick from the previous six years when the state reported on average around 3 million in overpayments each quarter. Thats a huge uptick from the previous six years when the state reported on average around 3 million in overpayments each quarter. Check status of your weekly claim or manage your account. Check status of your weekly claim or manage your account. Check status of your weekly claim or manage your account.

The tax rate for new-employers is set to be 300 for 2021 a decrease from 320 in 2020. The tax rate for new-employers is set to be 300 for 2021 a decrease from 320 in 2020. The tax rate for new-employers is set to be 300 for 2021 a decrease from 320 in 2020.

If you are searching for Ct Unemployment Claim On Hold 2021 you've reached the right location. We have 20 images about ct unemployment claim on hold 2021 adding pictures, pictures, photos, backgrounds, and much more. In these webpage, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Source Image @ taxnews.ey.com

What You Should Know About Unemployment Tax Refund

Source Image @ fileunemployment.org

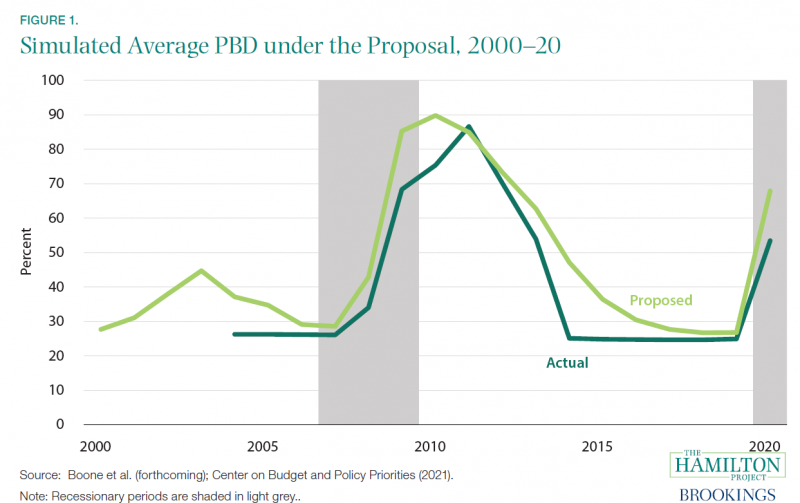

A Plan To Reform The Unemployment Insurance System In The United States The Hamilton Project

Source Image @ www.hamiltonproject.org

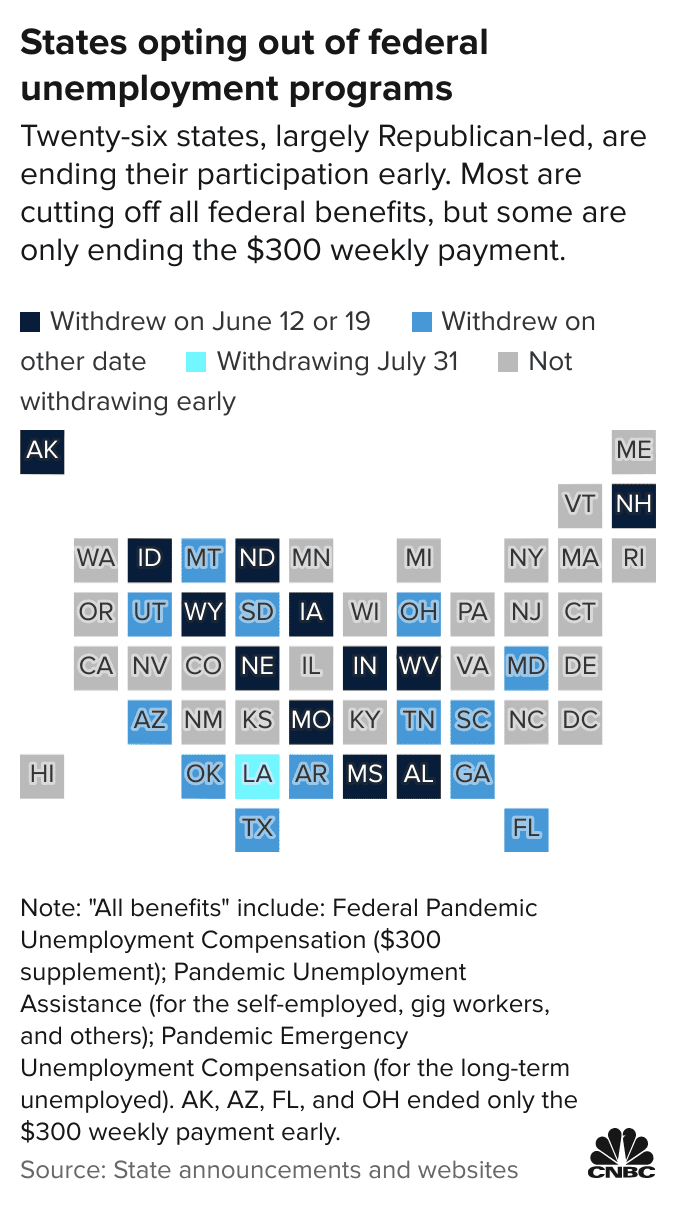

States Are Ending Federal Unemployment Benefits Early What To Know

Source Image @ www.cnbc.com

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22363790/EwH7osaWgAA9Ft8.jpeg)